Pre-Qualified Deal Flow for Capital Providers

What We Do

ScaleOn designs, builds and operates external origination aligned with the capital provider’s investment criteria and deployment rules that sources, filters, and delivers only pre-qualified, lender-ready deal opportunities to capital allocators.

Our origination replaces manual screening, removes intermediaries, and standardizes submissions so capital allocators only receive vetted, decision-ready deals.

The result: consistent, credible, traceable deal flow at an institutional scale for lenders who cannot run public marketing or handle unstructured inbound.

The Problem

Most capital providers are flooded with ineligible, unverified, and non-actionable deal flow. They face recurring issues such as:

- Overwhelmed by inbound noise: brokers, daisy-chains, fee-hunters, and recycled decks.

- Internal time wasted filtering out incomplete, unverifiable, or non-institutional submissions.

- No way to validate mandate, authority, or credibility of the party submitting the deal.

- Projects arriving with missing collateral proof, weak developers, or no SPV/structure.

- Confusion created by intermediaries presenting mismatched, non-bankable proposals.

- Difficulty securing clean, first-line access to developers who actually meet underwriting standards.

- Inconsistent formats: every deal arrives differently, slowing assessment and increasing friction.

- Reputational risk when relying on informal channels for origination instead of a controlled intake.

Our Solution

ScaleOn builds a controlled origination that eliminates noise and delivers only institution-ready opportunities:

- A dedicated, external intake engine aligned with the lender’s products and underwriting model.

- Pre-qualification that filters out ineligible parties before they ever reach the lender.

- A standardised intake form capturing all data required for institutional-level assessment.

- Document capture, collateral information, and automated pre-screening for completeness.

- Eligibility rules that block daisy-chains, unverifiable brokers, or mismatched proposals.

- Screening outputs summarised into a clean, concise, decision-ready package.

- A gatekeeping layer protecting the lender’s confidentiality and saving internal time.

- Delivery only of projects that meet financial, structural, and counterparty criteria.

OUR FUNNELS

What We’ve Built

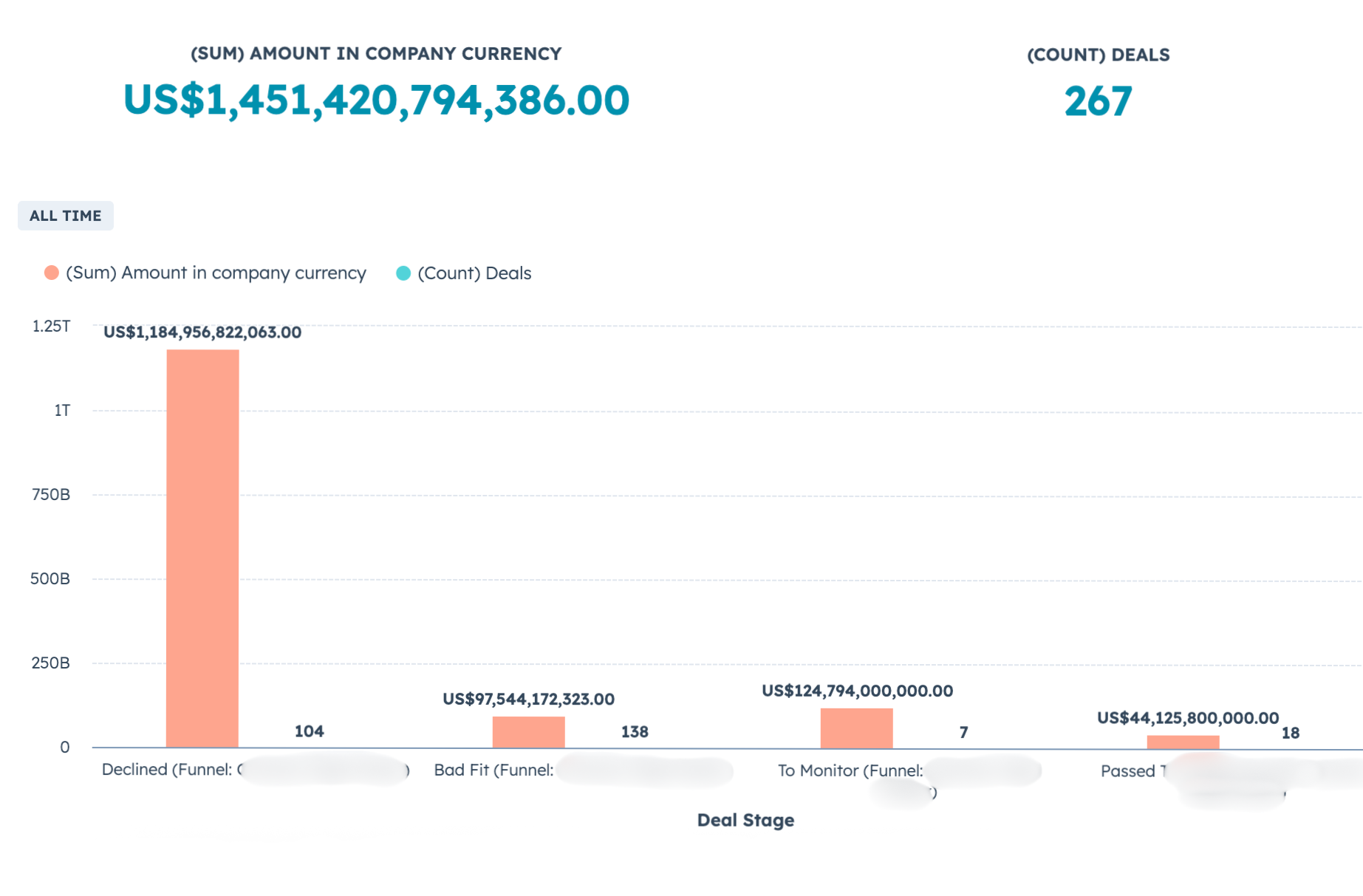

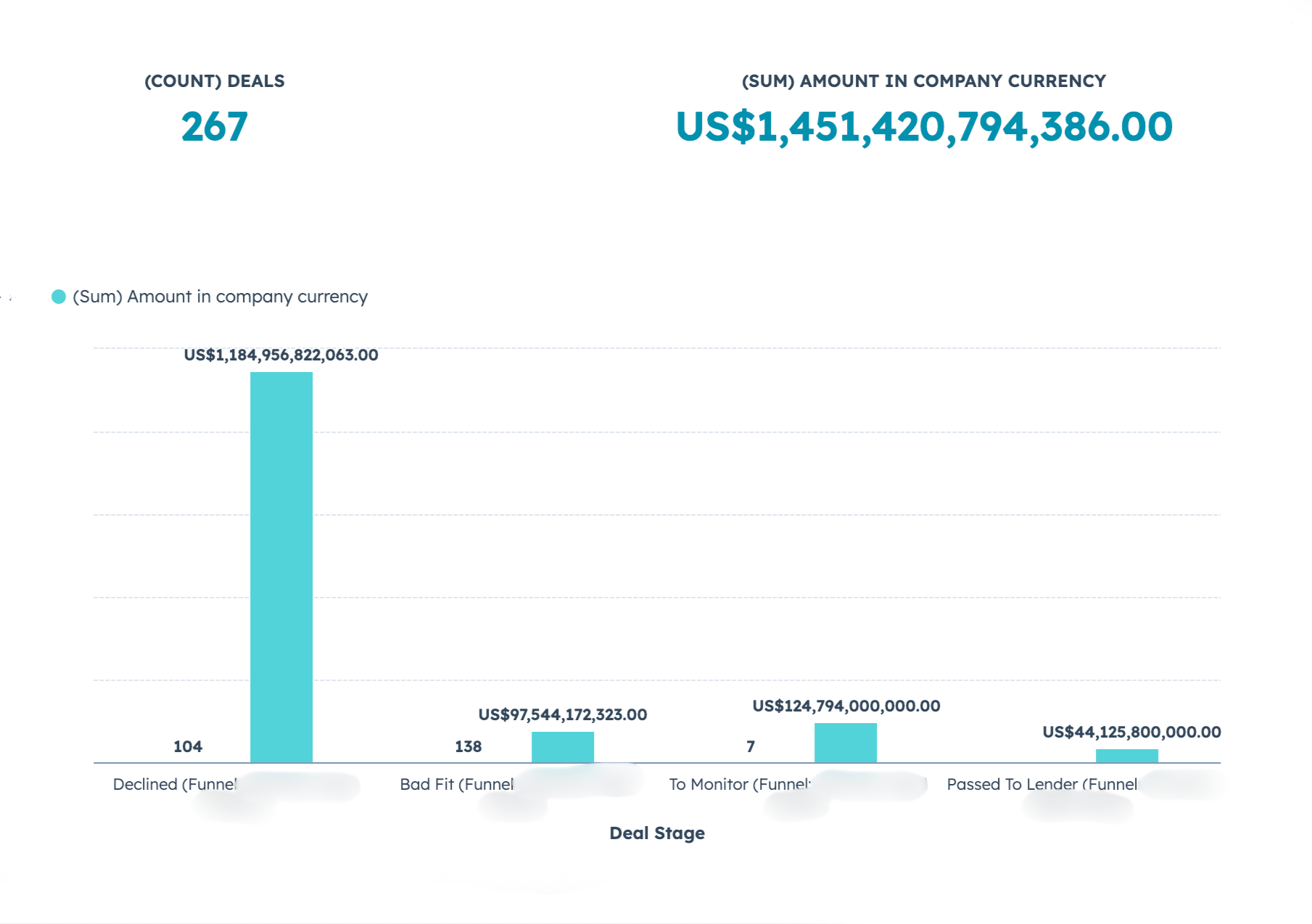

Our systems have powered investor and deal pipelines in high-value capital markets:

$1.45+ trillion deal flow originated for a global lender with $250B+ book value

$44B+ deal value under negotiation

850+ investor prospects for the $2.5B CRE portfolio for US investment manager

CASE STUDY

Proof: AltFin.net

Our flagship deal origination engine, AltFin.net, built for private debt lenders with a $250B+ book value, has generated over $1.5 trillion deal flow without calls, networking and ads.

- For lenders: clean, lending-compliant projects.

- For sponsors: one streamlined inquiry.

1.3k+

Inquiries screened

$1.45T+

deal Flow Originated

$44B+

Under Negotiations

WHO YOU ARE

Who This Is For

Banks and Mainstream Lenders

Private Credit Funds

Private Lenders

Institutional Investors

Not for intermediaries, startups or unmarketable financial products.

SOURCING FOR

Sectors We Cover

Project Finance

Infrastructure and Construction Financing

Hospitality and Real Estate Development

Renewable Energy Finance

Acquisitions and Asset-Based Loans

Not for bonds, SBLCs, off-market instruments.

WORKFLOW

How Our Origination Works

Step 1

We design a gatekeeping funnel around your financial products, sectors, and capital deployment profile. The gate eliminates ineligible applicants and intermediaries.

Step 2

Each enquiry is filtered through your intake criteria: your sector and capital deployment needs, and deal type sought. Only viable submissions pass through.

Step 3

Pre-qualified opportunities arrive in a clean, consistent format you can review immediately. You receive fewer but higher-quality deals, supported documentation, and clear next steps.

OUTPUT

What Lands in Your Inbox

Submission packages aligned to your institutional due diligence standards:

- A streamlined deal summary with key metrics clearly outlined.

- Supporting attachments for fast review.

- Clear next step: Decline or Approve – and we’ll facilitate the intro to the inquirer for you.

ENGAGEMENT MODEL

How We Work

1.

You provide the key information so we can understand your financial product, deployment criteria, and deal flow origination requirements.

2.

We assess your financial products’ marketability, compliance, scalability, and whether it can support a commercially viable origination funnel.

3.

If aligned, your financial product is placed on an existing or via a dedicated engine configured to your intake parameters built and operated by ScaleOn.

Our Engagement Model

Retained engagements only: monthly fee plus a performance-based origination fee.

WHY SCALEON

Institutional-Grade Origination, Delivered.

Reduced workload by eliminating ineligible inbound deal flow.

Improved deal quality so you only see credible, investable deals.

Predictable, controlled pipeline aligned with your financial product.

Gatekeeping buffer that protects your time and reputation.

Warm, credible, pre-qualified deals ready for your assessment.

Capital provider seeking pre-qualified deal flow?

Reach out to see if we are a fit.